Bitcoin emerged in 2009 as a revolutionary digital currency conceptualized by an enigmatic figure known only as Satoshi Nakamoto. This introduction to the world of finance promised a decentralized mode of transaction, free from government oversight and banking institutions. As you delve into the intricacies of Bitcoin, this post aims to demystify the digital currency, elucidating its mechanics, uses, and potential impacts on the global financial landscape, making it accessible and understandable to the average person.

Contents

The Basics of Bitcoin

Bitcoin, a form of digital currency or cryptocurrency, operates without a central authority, differentiating it from traditional fiat currencies. Utilizing a decentralized ledger known as the blockchain, it records transactions across multiple computers to ensure security and transparency. This structure not only prevents any single entity from controlling the network but also secures it from fraud and manipulation. As such, Bitcoin offers a unique financial freedom and privacy that traditional banking systems cannot.

Each Bitcoin transaction is verified by network nodes through cryptography and recorded in a publicly dispersed ledger called a blockchain. The decentralized nature of Bitcoin means that it does not require a central bank or single administrator. This system provides users with significant advantages in terms of lower transaction fees compared to traditional online payment mechanisms. Furthermore, it enables users anywhere in the world to send and receive money at any time, without the need for intermediaries.

How Bitcoin Works

The core technology behind Bitcoin is the blockchain, which acts as a public ledger of all transactions in the network. When a transaction is made, it is broadcast to the network and validated by miners—users with high-power computers on the Bitcoin network. These miners solve complex cryptographic challenges to verify transactions and add them to the blockchain, earning Bitcoins in return as a reward. This process secures the network and ensures the integrity of transaction data.

Once a transaction is confirmed, it is recorded in a “block” and added to the existing blockchain. Each block contains a unique code called a “hash,” which links it to the previous block, thus creating a secure and unbreakable chain. This immutability is crucial as it prevents tampering and ensures that each Bitcoin cannot be spent more than once. The transparency and security of this system have major implications for how financial transactions are conducted globally.

Acquiring Bitcoin

Bitcoin can be obtained in several ways, the most common being through a cryptocurrency exchange. Users can sign up for an exchange, undergo a verification process, and purchase Bitcoin using fiat currencies like the USD or EUR. This method is straightforward and accessible, making it popular among first-time buyers. Additionally, exchanges provide a secure platform where users can store, send, and receive Bitcoin.

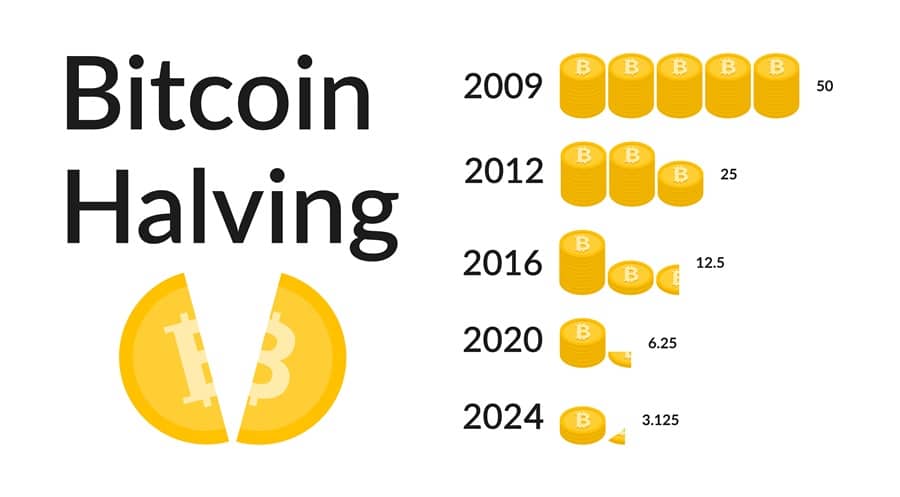

Another method of acquiring Bitcoin is through mining, which involves using specialized hardware to solve mathematical puzzles that validate and secure transactions. This process is critical for maintaining the blockchain’s integrity and adding new Bitcoins to the system. However, due to the increasing difficulty of these puzzles and the high cost of electricity and hardware, mining has become less feasible for average individuals, shifting predominantly to industrial-level operations.

The Value of Bitcoin

Bitcoin’s value is highly volatile, influenced by factors such as supply and demand, market sentiment, and geopolitical events. This volatility can lead to significant price swings, which can provide opportunities for high returns on investment. However, it also poses substantial risks, as dramatic price drops can occur just as quickly as rises. Investors and users must, therefore, exercise caution and consider their risk tolerance when dealing with Bitcoin.

Despite its volatility, Bitcoin has experienced significant appreciation over the years, drawing attention from both individual and institutional investors. Its potential as a hedge against inflation and traditional financial system instabilities has been widely discussed. As Bitcoin becomes more integrated into global commerce, its utility and value are likely to continue to grow, reflecting its increasing acceptance and maturation as a financial asset.

Using Bitcoin for Transactions

Bitcoin is not just an investment vehicle but also a practical currency for transactions. Across the globe, an increasing number of businesses and online retailers have started to accept Bitcoin as a payment method. This trend is driven by the lower transaction fees associated with Bitcoin compared to traditional credit card and banking fees. Furthermore, Bitcoin transactions provide anonymity and security, which is particularly appealing in an era where digital privacy concerns are growing.

The process of using Bitcoin for transactions is straightforward. Users can send or receive Bitcoin through digital wallets, which are applications that can be installed on a smartphone or computer. Each transaction is protected by cryptographic keys, ensuring that only the owner of the Bitcoins can spend them. This method simplifies the transaction process by eliminating the need for middlemen and significantly reduces the time it takes to process payments across borders.

The Risks and Benefits

Investing in or using Bitcoin comes with a unique set of benefits and risks. On the positive side, Bitcoin offers significant privacy and security benefits over traditional financial systems. Transactions are secured by blockchain technology, which provides a high level of encryption and an immutable record of transactions. Additionally, Bitcoin’s decentralized nature means that it is less susceptible to censorship or control by any single entity, making it an appealing option for those seeking financial autonomy.

However, the risks associated with Bitcoin should not be underestimated. The same features that offer privacy and security also make it a potential tool for illegal activities, such as money laundering or funding illicit transactions. Additionally, Bitcoin’s price volatility can result in significant financial losses. Regulatory uncertainty also poses a constant threat as governments around the world grapple with how to approach cryptocurrencies within their legal and financial frameworks.

The Future of Bitcoin

The future of Bitcoin, while promising, is shrouded in uncertainty and speculation. As digital currency continues to evolve, it could potentially revolutionize the global financial system by providing an alternative to traditional currencies. This revolution could lead to wider acceptance and integration of Bitcoin into everyday financial transactions, promoting a shift towards a more decentralized and transparent financial ecosystem.

Emerging technologies and trends, such as the increasing interest in blockchain applications beyond cryptocurrencies, are likely to influence Bitcoin’s trajectory. Additionally, regulatory developments will play a crucial role in shaping Bitcoin’s future. As governments begin to provide clearer guidelines and frameworks for the use of cryptocurrencies, the stability and acceptance of Bitcoin are expected to increase, potentially leading to broader adoption and increased market stability.

Embracing the Bitcoin Revolution

As Bitcoin continues to carve its niche in the global financial landscape, its potential to redefine monetary transactions remains significant. Despite its challenges, including volatility and regulatory scrutiny, Bitcoin’s innovative blend of privacy, security, and decentralization offers a compelling alternative to traditional banking. The ongoing evolution of Bitcoin will likely influence future financial systems and could herald a new era of economic empowerment, making it an exciting time to observe and participate in this digital currency revolution.