Bitcoin, the pioneering cryptocurrency, has always been at the forefront of financial discussions, especially with its dramatic price movements and groundbreaking technology. As the 2024 Bitcoin halving event approaches, there’s a growing buzz in the investment community. This article delves into the intricacies of Bitcoin halving, historical trends, expert predictions, and the unique factors surrounding the 2024 event. It aims to provide a comprehensive understanding of why this event is pivotal and what it could mean for investors and the cryptocurrency market as a whole.

Contents

Exploring the Concept of Bitcoin Halving

Bitcoin halving, a core mechanism of its protocol, is a scheduled reduction in the reward miners receive for adding new blocks to the blockchain. Occurring approximately every four years, this event is a deliberate design to mimic the scarcity and deflationary aspects of precious metals. By halving the mining reward, Bitcoin’s new supply rate decreases, impacting its overall circulation. This event is not just a technical adjustment; it holds significant implications for Bitcoin’s value, often viewed as a catalyst for price changes.

The anticipation surrounding a halving event stems from its potential impact on supply and demand dynamics. As the reward for mining new blocks halves, the rate at which new bitcoins enter circulation slows down. This reduction in supply, if accompanied by steady or increasing demand, can lead to a rise in Bitcoin’s price. Historically, halving events have been followed by periods of increased price volatility and market interest. However, it’s crucial to understand that while halving affects supply, various other factors also influence Bitcoin’s price.

Historical Trends Post-Halving

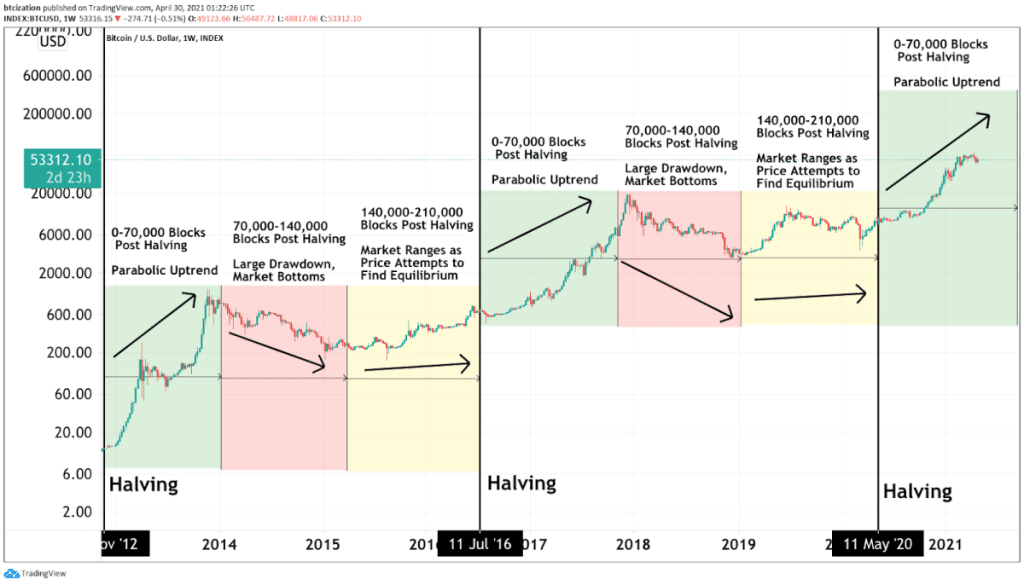

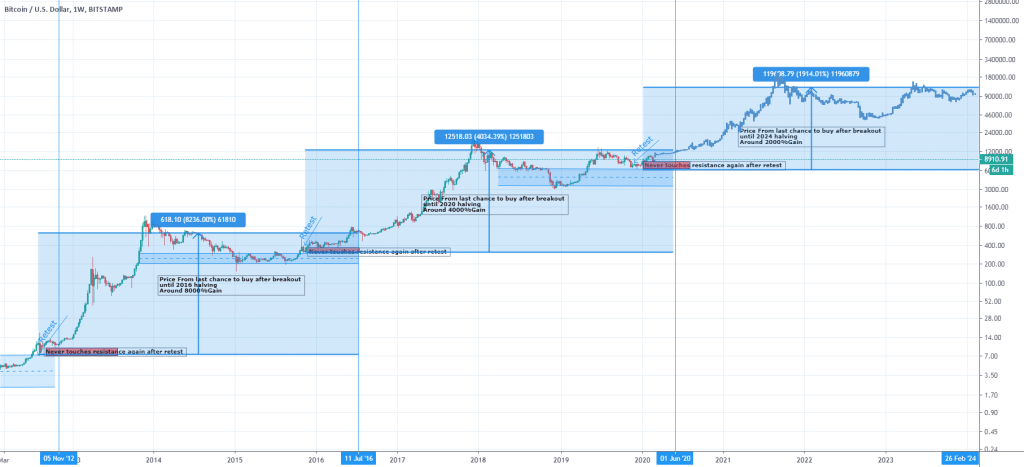

Historically, Bitcoin has exhibited significant price movements following its halving events. The first halving in 2012 saw Bitcoin’s price increase substantially in the following year. Similarly, the 2016 halving preceded a remarkable bull run that peaked in late 2017. These patterns have contributed to a popular belief that halving events are bullish for Bitcoin’s market value, creating a sense of optimism among investors as each halving approaches.

However, it’s important to note that while past halvings have been followed by price increases, correlation does not imply causation. The cryptocurrency market is influenced by a myriad of factors, including technological developments, regulatory changes, and broader economic conditions. Therefore, while historical trends provide valuable insights, they should be considered alongside a range of other market indicators when predicting future movements.

The 2024 Halving: What’s Different?

The 2024 Bitcoin halving is drawing attention not only because of historical precedents but also due to the evolving context in which it is occurring. The global economic landscape has changed significantly since the last halving, with factors like inflation rates, monetary policies, and geopolitical tensions playing a more pronounced role. These elements could affect investor sentiment and market dynamics, potentially influencing the impact of the halving on Bitcoin’s price.

Moreover, the cryptocurrency ecosystem itself has undergone substantial growth and transformation. The increasing involvement of institutional investors, advancements in blockchain technology, and heightened regulatory scrutiny could all shape the market’s response to the 2024 halving. These developments suggest that while historical patterns provide a framework, the upcoming halving could unfold in a markedly different manner, influenced by a unique set of factors.

Expert Predictions for 2024

Experts and analysts offer varied predictions for Bitcoin’s trajectory following the 2024 halving. Some anticipate a significant price surge, drawing on historical patterns and the expected impact of reduced supply on market dynamics. They argue that the halving could trigger increased investor interest, potentially leading to a bullish market cycle.

Conversely, other experts urge caution, pointing out that the cryptocurrency market has matured significantly since the last halving. With a broader investor base, including more institutional participants and an evolving regulatory landscape, the market’s response to the 2024 halving might differ from past events. These analysts emphasize the importance of considering a range of factors, including technological advancements and global economic conditions, in shaping Bitcoin’s post-halving future.

Institutional Interest and Market Dynamics

The growing interest of institutional investors in Bitcoin is a critical factor influencing the market dynamics as the 2024 halving approaches. This shift from a predominantly retail-driven market to one with significant institutional involvement could alter the way Bitcoin reacts to the halving. Institutions bring not only substantial capital but also a different investment approach, focusing on long-term value and stability. Their participation could lead to increased market maturity and potentially less volatility. However, it also means that Bitcoin’s price movements could become more closely correlated with traditional financial markets.

The dynamics of the market are also being reshaped by the broader adoption of Bitcoin and its integration into financial systems. Products like Bitcoin futures, ETFs, and various investment funds have made it easier for institutional investors to enter the cryptocurrency space. This increased accessibility could lead to a surge in demand around the halving event as more investors seek to capitalize on potential price movements. Yet, it’s important to consider that these new avenues also open the door for greater market manipulation and speculation. The interplay of these factors will be crucial in determining Bitcoin’s price trajectory post-halving.

Potential Risks and Challenges

While the halving event is often met with optimism, it’s essential to acknowledge the risks and challenges that could influence its outcome. One significant concern is the potential impact on miners’ profitability. As rewards for mining decrease, smaller mining operations might find it difficult to sustain their activities, possibly leading to a concentration of mining power among larger entities. This centralization of mining power could raise security concerns and affect the decentralized nature of the Bitcoin network.

Market volatility is another inherent risk associated with the halving. Bitcoin and the broader cryptocurrency market are known for their price fluctuations, which could be exacerbated by the halving event. Investors should be prepared for potential short-term price swings. Additionally, external factors such as regulatory changes, technological advancements, and macroeconomic trends can also significantly impact the market. Navigating these uncertainties requires a balanced and informed approach to investment in Bitcoin.

Preparing for the Halving: Investor Strategies

As the 2024 Bitcoin halving nears, investors may consider various strategies to navigate the event. Diversification remains a key strategy; spreading investments across different asset classes can help mitigate risk. For those looking to invest directly in Bitcoin, timing the market can be challenging, so a dollar-cost averaging approach might be more prudent. This involves investing a fixed amount at regular intervals, regardless of the price, reducing the impact of volatility.

Long-term planning is also crucial when considering investments in Bitcoin around the halving event. Given the historical price increases following past halvings, a long-term hold strategy could be beneficial. However, investors should also be aware of the potential for post-halving price corrections and plan accordingly. Staying informed about market trends and developments is essential, as is consulting with financial advisors for personalized advice. Ultimately, each investor’s approach should align with their risk tolerance and investment goals.

Bitcoin’s Halving Horizon Awaits

As the 2024 Bitcoin halving draws near, it presents a pivotal moment for investors and the cryptocurrency market. While historical trends offer insights, the unique economic and market conditions of today suggest a cautious approach. This event calls for diligent research, strategic planning, and an understanding of the evolving landscape. Embrace the opportunity to be part of this significant moment in Bitcoin’s journey, staying informed and prepared for the potential shifts it may bring to the world of cryptocurrency.