Tips for Creating Strong Passwords Without a Manager

In the digital age, securing our online presence with strong passwords is paramount. Many users…

Best Tech Gadgets For Seniors

In today’s rapidly evolving tech landscape, seniors can greatly benefit from gadgets designed to enhance…

What You Need To Know About Windows 11 Copilot Feature

Windows 11 is elevating the user experience with the integration of advanced AI features, prominently…

Inside Look At LG’s Brand-New G4 and C4 OLED TVs

LG has long been at the forefront of OLED technology, continuously pushing the boundaries of…

How To Choose Between Google Pixel and Samsung Galaxy

In today’s rapidly evolving smartphone market, choosing between Google Pixel and Samsung Galaxy can feel…

The Evolution of Social Media Platforms

Social media platforms have revolutionized the way people communicate, connect, and consume content, evolving from…

Another Step Forward In The Digital World

Get your daily fix of tech news updates. Sign up below!

How Voice Assistants Can Improve Your Daily Life

In today’s fast-paced world, voice assistants have emerged as a revolutionary technology, seamlessly integrating into…

Must-Have Apps for Your New Samsung Galaxy

Unlocking the full potential of a Samsung Galaxy can transform it from a mere gadget…

Smart Home Upgrades to Look Out For

The rapid advancement of smart home technology is transforming living spaces into hubs of convenience,…

High-Tech Pet Gadgets for Animal Lovers

In a world where technology seamlessly integrates into every aspect of life, the realm of…

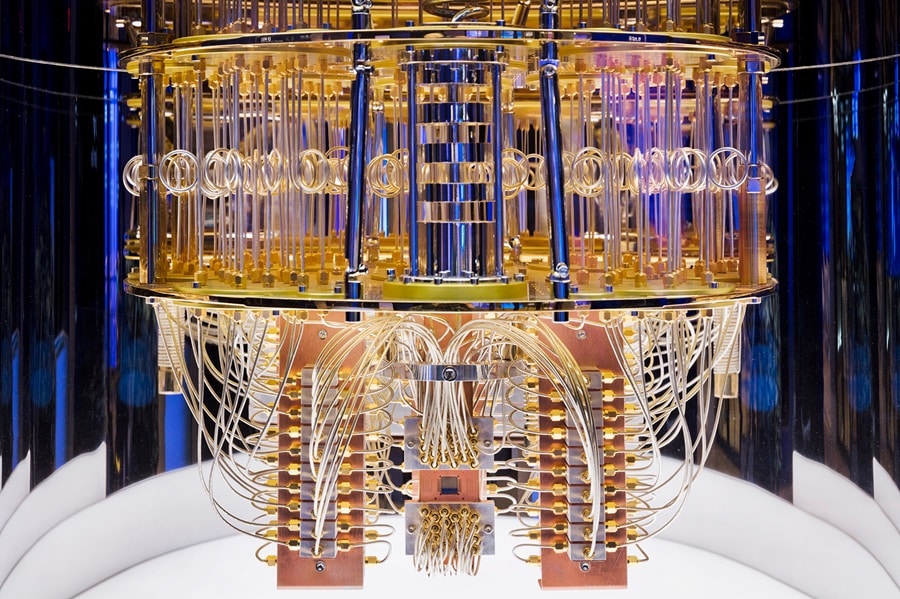

How Quantum Computing Is Redefining Problem Solving

Quantum computing stands on the brink of revolutionizing the approach to solving the world’s most…

7 Ways AI is Revolutionizing Personal Finance Management

Artificial Intelligence (AI) is revolutionizing the way people manage their finances, ushering in a new…

Implementing AI in Your Business: A Step-by-Step Strategy

In the rapidly evolving digital landscape, artificial intelligence (AI) has emerged as a pivotal tool…

Is Apple’s iPhone Privacy Really Better? An In-Depth Look

In the digital age, the sanctity of personal privacy is more contested than ever, with…

Android vs. iOS: Which Platform Suits You Best?

In the dynamic landscape of mobile technology, the battle between Android and iOS platforms remains…

Top 10 Breakthrough Technologies of 2024

As the world advances further into the 21st century, the landscape of technology continues to…

What Will The Internet Look Like In 10 Years?

In the span of just a few decades, the Internet has transformed from a fledgling…

7 Essential Security Apps for Your Smartphone

In an era where smartphones are as indispensable as the air you breathe, securing these…

Is The iPhone 15 Worth The Price?

In the dynamic realm of smartphones, each new release sparks a flurry of debate and…

How Chatbots Are Changing Everyday Life

The dawn of the digital era has witnessed the remarkable evolution of chatbots, transforming them…