Personal finance management is a key aspect of your life that can significantly impact your financial health and future. With technology at your fingertips, managing your budget has become much simpler. Various budgeting apps, especially for iOS, are available to streamline this process, providing you with real-time updates, intuitive interfaces, and personalized budgeting solutions. This post aims to explore the top budgeting apps for iOS that can transform how you handle your personal finances. There’s something for everyone, from all-in-one finance apps to simplified budgeting tools.

Contents

- 1 Understanding What Makes A Good Budgeting App

- 2 Mint: All-In-One Finance App

- 3 YNAB (You Need A Budget): Effective Budget Management

- 4 PocketGuard: Keeping Spending In Check

- 5 Goodbudget: Modern Envelope Budgeting

- 6 Personal Capital: Beyond Budgeting

- 7 EveryDollar: Budgeting With A Purpose

- 8 Wally: Simplified Budgeting

- 9 The Bottom Line

Understanding What Makes A Good Budgeting App

Budgeting apps can vary in terms of design and functionality. Nevertheless, some essential features are universal. A good budgeting app should offer an intuitive interface for ease of use. It should provide the ability to sync with various accounts and cards, allowing you to monitor all your transactions in one place. Customization options for budgets, spending categorization, and alerts for any unusual activity or nearing budget limits are also crucial for effective personal financial management.

The advantages of using a budgeting app are numerous. A good app provides real-time updates on your spending habits, so you always know where your money is going. Also, you can access it anytime, anywhere, allowing you to make informed financial decisions on the go. Plus, the visual data representation in these apps helps you to understand your spending patterns better, making it easier for you to adjust your habits if necessary.

Mint: All-In-One Finance App

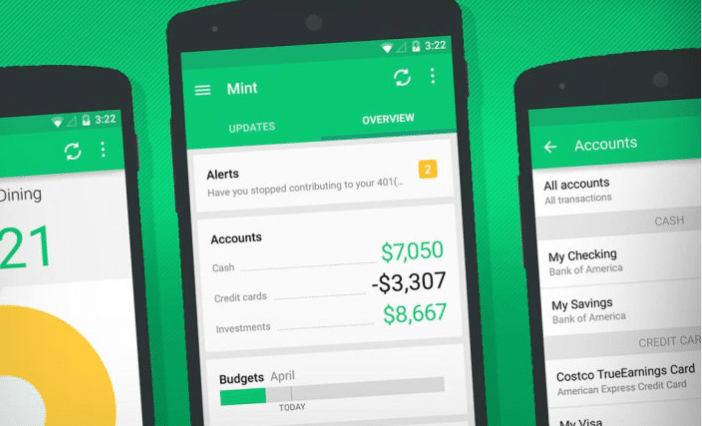

Mint, developed by Intuit Inc., is a widely popular budgeting app that functions as an all-in-one personal finance tool. It allows you to track your bills, expenses, and income by syncing with your bank accounts and credit cards. Moreover, it provides budget creation tools, credit score checks, and even investment tracking, presenting a holistic view of your financial situation.

While Mint offers a comprehensive set of features, it’s important to consider the trade-offs. Mint’s interface may seem overwhelming to some users due to the extensive information it provides. Its budgeting tools, though customizable, might not offer the flexibility that certain users may prefer. However, Mint could be an excellent choice for those who want an all-inclusive finance app to monitor a wide range of financial elements.

YNAB (You Need A Budget): Effective Budget Management

YNAB, short for You Need A Budget, offers a proactive approach to budgeting. It’s based on the principle of “giving every dollar a job,” encouraging you to allocate each dollar you earn towards something specific, whether that’s bills, savings, or investments. This way, YNAB helps users create a purposeful budget that discourages unnecessary spending.

However, YNAB does have a learning curve due to its unique approach, and it’s a paid app after a free trial. On the upside, many users report that the app pays for itself through the savings it helps them realize. If you’re looking for an app that encourages an active and mindful approach to budgeting, YNAB could be the right fit.

PocketGuard: Keeping Spending In Check

PocketGuard offers an easy and straightforward way to manage your money and keep your spending in check. Its standout feature, the “In My Pocket” tool, helps users determine how much they can safely spend after accounting for bills, goals, and necessities, providing a clear picture of disposable income.

Despite its user-friendly approach, PocketGuard may not be suitable for everyone. It lacks certain advanced features, such as detailed investment tracking or extensive customizable budgeting. However, for those seeking simplicity and clear insights into their daily spending allowance, PocketGuard is an excellent choice.

Goodbudget: Modern Envelope Budgeting

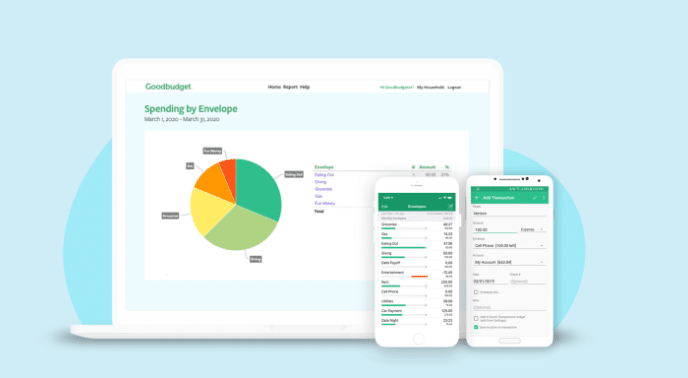

Goodbudget uses a modern interpretation of the traditional envelope budgeting system where you allocate money to different “envelopes” for each spending category. This app syncs across multiple devices, making sharing and managing household budgets with family members easy.

While Goodbudget offers a unique way to visualize and control your spending, it doesn’t automatically sync with your bank accounts or credit cards, so you must manually enter all transactions. Despite this, if you prefer the envelope method of budgeting and don’t mind a bit of manual data entry, Goodbudget can be a solid choice.

Personal Capital: Beyond Budgeting

Personal Capital takes budgeting to a new level by focusing on long-term financial planning. Along with tracking daily spending and budgets, it offers retirement planning, investing, and wealth management tools. It’s ideal for users who want a comprehensive view of their financial health and future.

However, the advanced features of Personal Capital can be a bit overwhelming for users seeking a simple budgeting tool. Its emphasis on investment analysis and wealth management may not be necessary for those looking to track daily expenses. But for those interested in a holistic financial platform, Personal Capital is a valuable resource.

EveryDollar: Budgeting With A Purpose

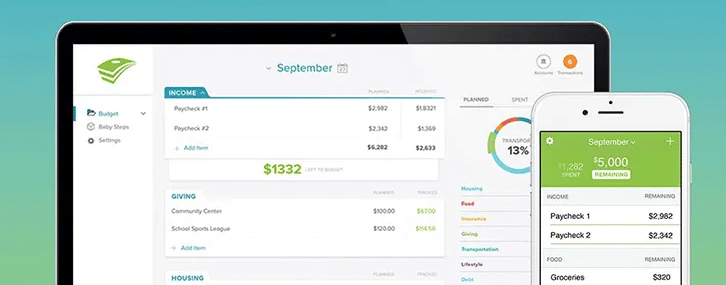

EveryDollar, developed by personal finance guru Dave Ramsey, utilizes the zero-based budgeting philosophy. This means every dollar of income you have is assigned a purpose, whether spending, saving, or investing.

The main drawback of EveryDollar is that you must upgrade to the paid version to have automatic transaction import. The free version requires manual entry of transactions. Yet, for those who are committed to the zero-based budgeting system and seek a structured approach to their finances, EveryDollar is a compelling choice.

Wally: Simplified Budgeting

Wally aims to simplify the budgeting process with its user-friendly interface and features. It offers expense tracking, budgeting tools, and insights to help users manage their finances effectively. One standout feature is its international usage capabilities, supporting various currencies and financial institutions.

Like some other apps, Wally requires a manual entry for tracking expenses which could be a drawback for some users. Despite this, if you’re looking for a simple and intuitive budgeting tool with international capabilities, Wally is worth considering.

The Bottom Line

Budgeting apps have made money management easier and more efficient in personal finance. Choosing the right app, however, depends largely on individual needs and preferences. While Mint offers a wide range of tools for comprehensive financial management, YNAB encourages a more active approach to budgeting. Apps like PocketGuard and Goodbudget offer simplicity and visualization, respectively, whereas Personal Capital goes beyond budgeting to provide investment insights. Regardless of your financial goals, one of these top budgeting apps for iOS can undoubtedly assist you on your journey to better financial health. So, consider your unique needs, explore these options, and take control of your finances today.