How Secure Are Popular Payment Methods?

Consumers use various payment methods when shopping online, but not all offer the same level of security. Credit cards, debit cards, digital wallets, and even cryptocurrency each come with their own risks and fraud protection measures. Credit cards generally provide better security features, such as fraud alerts and chargeback options, making them a safer choice compared to debit cards, which directly access a user’s bank account. Many banks also offer virtual credit cards—temporary card numbers that expire after use—to reduce the risk of fraud. However, these tools are only effective if consumers take additional precautions, such as enabling two-factor authentication and monitoring transactions regularly.

Digital wallets, such as PayPal, Apple Pay, and Google Pay, use encryption and tokenization to enhance security. These services do not directly share bank details with merchants, reducing the risk of data theft. Cryptocurrency transactions, while offering anonymity, are less protected in cases of fraud, as they are irreversible. The increasing popularity of Buy Now, Pay Later (BNPL) services also introduces security concerns, as third-party providers may not have the same fraud prevention measures as traditional banks. Understanding the strengths and weaknesses of each payment method can help shoppers make safer financial decisions when purchasing online.

Spotting and Avoiding Online Scams

Online scams have become more sophisticated, making it difficult for shoppers to distinguish legitimate websites from fraudulent ones. One of the most effective ways to avoid falling victim to scams is by checking whether a website uses HTTPS encryption, indicated by the padlock icon in the browser’s address bar. Fraudulent e-commerce websites often mimic real online stores, using stolen images and fake customer reviews to lure unsuspecting buyers. Scammers also take advantage of social media ads, promising deep discounts to trick shoppers into entering their payment details on a fake checkout page.

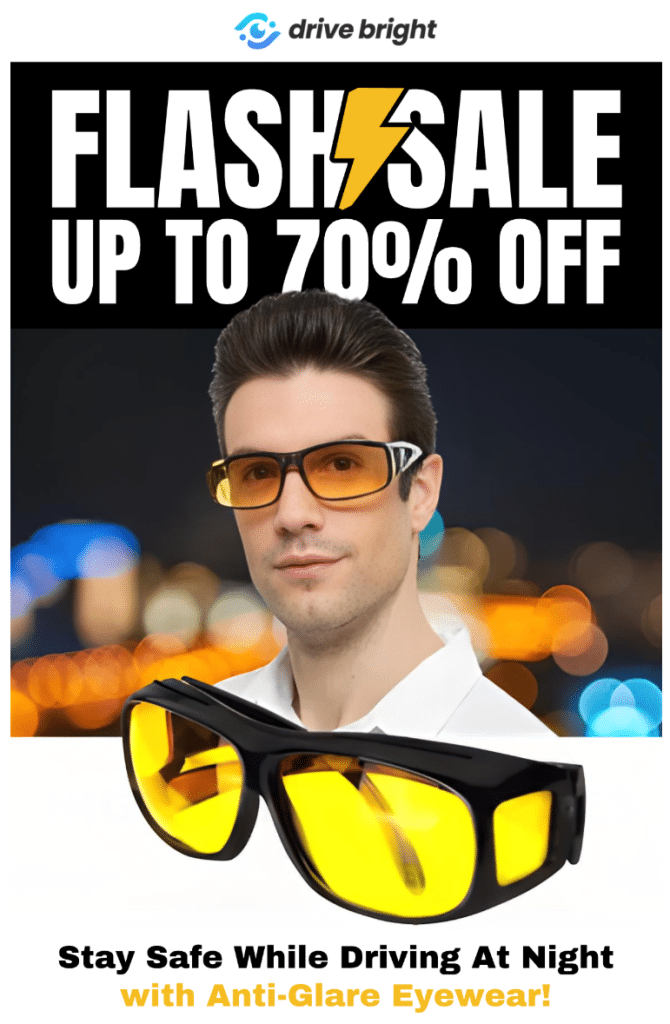

To avoid scams, shoppers should verify website legitimacy by reading independent customer reviews on trusted platforms rather than relying on testimonials displayed on the site itself. If a deal seems too good to be true, it often is—deeply discounted luxury items or high-demand products sold at unusually low prices can indicate a scam. Checking for valid contact information, such as a physical address and customer support details, can help determine whether a site is legitimate. Additionally, avoiding links sent via unsolicited emails or text messages prevents users from falling into phishing traps designed to steal financial information.

Best Practices to Keep Your Bank Details Safe Online

Taking proactive steps to protect bank details can significantly reduce the risk of financial fraud. One of the most effective measures is using strong, unique passwords for each shopping site and enabling two-factor authentication (2FA) when available. Many people make the mistake of reusing the same password across multiple accounts, making it easier for hackers to gain access if one site experiences a data breach. Regularly updating passwords and using a password manager to store credentials securely can enhance online security.

Shoppers should also be cautious about saving payment details on e-commerce platforms, as stored information can be compromised in a cyberattack. Using virtual credit cards—temporary card numbers that expire after a transaction—adds an extra layer of security when shopping online. Monitoring bank statements and credit card transactions frequently allows users to detect unauthorized purchases early and report them immediately. Finally, using a secure network connection rather than public Wi-Fi when making online transactions prevents hackers from intercepting sensitive payment information.